Much like estate planning, funeral pre-planning allows you to give your loved ones the gift of peace of mind. They just won’t know until the day they need it.

Many families are comforted by the knowledge that their loved ones will be spared the hardship and stress of making decisions on their behalf at such a difficult and sensitive time. Many people called upon to make final arrangements at time of need are doing it for the first time. The combination of inexperience and emotion can result in loved ones overspending, and possibly buying services and products they don’t need.

Pre-planning offers a number of benefits:

- Planning ahead gives your family and friends peace of mind. If you should die without pre-planning, the people you love will be left with a great deal of uncertainty during an already difficult time. Pre-planning leaves them with a clear idea of your wishes and intentions.

- You will gain peace of mind knowing your family and friends are relieved of the financial burden often associated with making funeral arrangements when a death occurs.

- Pre-planning also provides direction to the executor of your estate.

- Pre-planning gives you the opportunity to weigh your decisions, from how much money you wish to spend to services you desire to hold.

Along with several other service providers, we partnered with Chapman Funerals & Cremations, Bridgewater to create this helpful resource: [link]

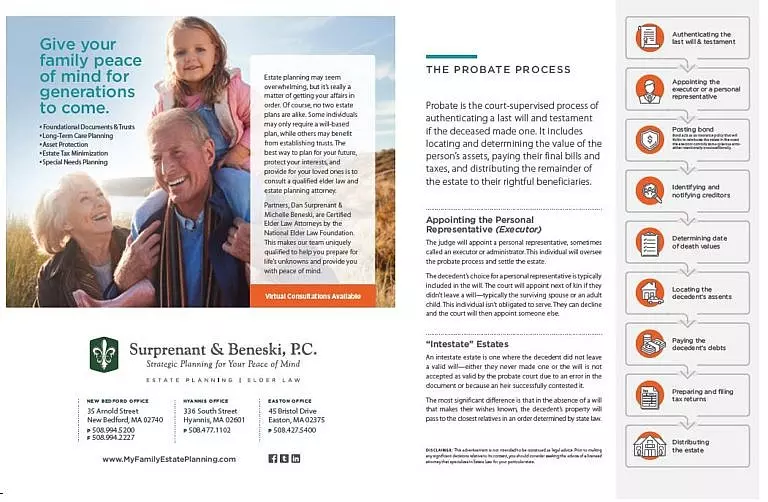

Please take a moment to review the information we shared regarding the probate process on pages 54-55. This is a simple guide to the process. More importantly, we would like to point out how impactful it can be to create an estate plan so, that when your loved ones are faced with administering your estate, it will be a smooth, expedient process with minimized expense and stress.

Estate Planning is the process of making arrangements during your life for what will happen to your estate when you become incapacitated or die. This can mean everything from planning ahead for your burial, to distributing your assets to your friends and family — including your home, vehicle, investments, savings accounts, and personal possessions. Estate planning is not only for the extremely wealthy or the elderly. There are important steps you can take to plan ahead at every stage of life’s journey, whether you are purchasing a new home or welcoming a new child into the world.

The goal of probate is to manage the distribution of the deceased person’s estate to their designated heirs and their chosen beneficiaries, while also resolving any debts owed to creditors.

Even in the most straightforward circumstances, probate can stretch on for months or even a year or more, preventing your loved ones from moving forward or getting access to important assets or funds. Meanwhile, probate can quickly become expensive, using up a portion of an estate’s value in fees, court costs, and, in some cases, taxes. Finally, documents entered into probate become a matter of public record. Many people want to avoid probate in order to preserve their family’s privacy.

Creating an estate plan can streamline and expedite probate, and may allow many of your most important assets to bypass the process altogether. Broadly speaking, an attorney can assist you in putting money and possessions into a trust to allow them to bypass probate. Meanwhile, your attorney may also be able to help you create a strategy for naming beneficiaries on many different types of assets, including real estate; bank accounts; certificates of deposit; and stocks, bonds, and securities.

Contact us to get started on your own estate plan and prepare to give your loves one the gift of peace of mind.

To read our article on probate (pages 54-55) and to read others, simply click here!

©Surprenant & Beneski, P.C. 35 Arnold Street, New Bedford, MA 02740, 336 South Street, Hyannis MA 02601 and 45 Bristol Drive, Easton MA 02375. This article is for illustration purposes only. This handout does not constitute legal advice. There is no attorney/client relationship created with Surprenant & Beneski, P.C. by this article. DO NOT make decisions based upon information in this handout. Every family is unique and legal advice can only be given after an individual consultation with an elder law attorney. Any decisions made without proper legal advice may cause significant legal and financial problems.