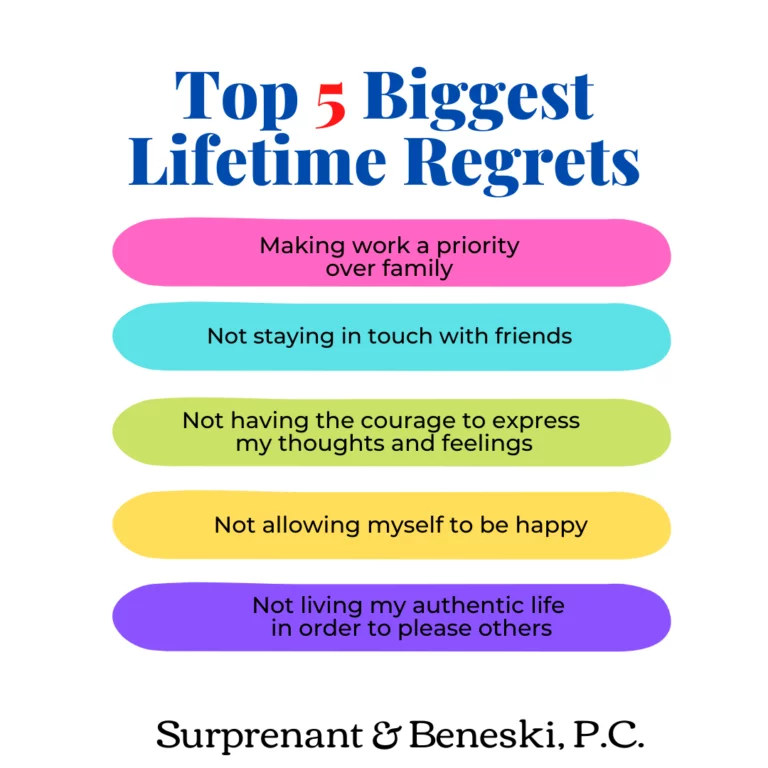

Failing to complete your estate plan may not be among the top 5 lifetime regrets but it can certainly have the same impact.

Estate Planning is one of these tasks that often fall under “discretionary spending,” and because it has the stigma of having to contemplate your own death, it often drops to the bottom of the to-do list. Many families learn the hard way that failure to plan timely, or failure to keep the plan current and relevant to the changing family dynamic, results in expensive, contentious and lengthy estate administration.

The thing about estate planning is that once the person is gone, there is no do-over. The “could have” or “should have” afterthoughts are helpless in the face of the facts – it will cost so much more to administer the estate than if there was some planning involved.

There is no substitute to being proactive and responsible in setting up your estate plan and in keeping it current and befitting the changing needs and circumstances that life inevitably brings about as time goes by.

Estate Planning is not a one-time session—it is an ongoing process. As the years go by, your circumstances will change, and so will your Estate Planning needs. We are prepared to provide comprehensive services and routine follow-ups to ensure your Estate Plan accomplishes your present and future goals.

Are you looking for professional guidance in setting up your Estate Plan? This is one of the most important decisions you will make during your life.

A skilled and experienced attorney can help you choose the right Estate Planning tools:

- Ensure each document is fully compliant with current laws, customized for your family, and validly executed.

- Develop a plan that minimizes taxes/expenses and maximizes what your Beneficiaries receive

- Determine what happens to you, and your financial affairs if you become incapacitated

- Develop an effective Business Succession Plan

- Help your loved ones avoid Probate (a long, complex & arduous process)

- Protect what you pass to your Beneficiaries from their own creditors, litigation, or divorce

- Safeguard the inheritance of a Beneficiary with special needs

- Ensure there are provisions in place for the care of your pets

Let the Law Offices of Surprenant & Beneski, PC guide you through the process of creating an Estate Plan that will ensure your loved ones will receive the support they need when you are gone, and create a foundation for your legacy.

Learn more about Estate Planning by calling 508-994-5200 or contacting us online today.

©Surprenant & Beneski, P.C. 35 Arnold Street, New Bedford, MA 02740, 336 South Street, Hyannis MA 02601 and 45 Bristol Drive, Easton MA 02375. This article is for illustration purposes only. This handout does not constitute legal advice. There is no attorney/client relationship created with Surprenant & Beneski, P.C. by this article. DO NOT make decisions based upon information in this handout. Every family is unique and legal advice can only be given after an individual consultation with an elder law attorney. Any decisions made without proper legal advice may cause significant legal and financial problems.