Many Americans don’t know about them or fail to use them, despite the advantages.

Even though health saving accounts (HSA) are an excellent retirement tool, many people still don’t know about them or take advantage of them, according to CBS Moneywatch in “Many savers missing out on the HSA’s benefits for retirement.”

What are the Benefits of HSAs?

One strength of an HSA is, unlike flexible spending accounts, HSA funds never expire, and they stay with you from job to job. HSA account holders have accumulated more than $51 billion in these special savings plans, a 20.4% increase since 2017. The number of HSAs exploded by more than 11%, totaling 23.4 million accounts.

Despite these numbers from the 2018 Midyear Devenir HSA Market Survey, many people who have HSAs aren’t taking advantage of the tremendous long-term benefits the accounts offer. Through the first half of 2018, the story reports that total HSA contributions were nearly $20 million, while withdrawals totaled more than $13.7 million.

In other words, more people are using HSAs as a pass-through and are receiving only a small benefit of using tax-free dollars to pay for out-of-pocket medical costs.

The study indicates that more than 80% of HSA assets are not invested in any of a wide range of possible available investments. Invested HSA assets total only $10 billion, a small percentage of the overall accounts. HSAs with invested assets have an average balance of more than $16,000—seven times higher than those without invested assets.

HSAs present great potential value. However, most people don’t understand the opportunity they present.

In fact, people are best served by making the maximum contribution before putting money into another account, with the exception of the matching contribution from their employer’s 401(k) plan.

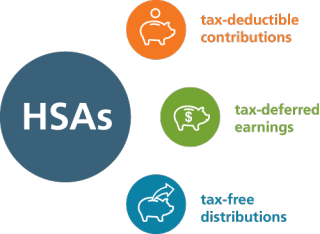

The money you invest in an HSA is tax-free when it goes into the account, grows in the account tax-free and it’s tax-free when it is used for qualified medical costs. It’s a three-way tax free!

To contribute to an HSA, you must be covered under a health insurance plan with an annual deductible of at least $1,350 for an individual and $2,700 for a family. The maximum annual contribution is $3,450 in 2018 for an individual and $6,900 for a family. If you are 55 or older, you can contribute an additional $1,000.

Remember, the money must be used for qualified medical expenses, although there is considerable flexibility. There are no time limits as to when the money must be used. There’s no age at which you have to start taking money out of the HSA, as there are with IRAs.

If your budget allows, contribute to the HSA and try not to use it for out-of-pocket medical expenses. If there is money in the HSA when you die, and if your spouse is the named beneficiary, the spouse becomes the account owner and can use it. The biggest downside to the HSA, is if you fail to name your spouse as a beneficiary. In that case, the account is fully paid out at your death and is considered taxable income to the non-spouse beneficiary.

An estate planning attorney can advise you on creating an estate plan that fits your unique circumstances and may include an HSA.

Reference: CBS Moneywatch (Sep. 17, 2018) “Many savers missing out on the HSA’s benefits for retirement”