Erin L. Nunes, Esq.

Why Experts Say It Is Important to Start Your Plan Now

As aptly stated by the long-term care experts at the Mayo Clinic, “If you’re considering long-term care options for yourself, a parent or another loved one, start the research and discussions early. If you wait, an injury or illness might force your hand – leading to a hasty decision that might not be best in the long run.”

As an elder law and estate planning attorney, I agree. Planning ahead now for any future long-term care needs enables you to stay ahead of the curve and remain in control of your life. By starting to plan now, you’ll never be at the mercy of the unforeseen changes in your health as you age. Early planning provides you with more choices for care as well as greater options for paying for care that won’t place your or your family’s financial assets at risk.”

Here are a few potential scenarios to consider where proactive planning may benefit you:

- Moving to a safer, more supportive living environment

- Negotiating a serious health crisis

- Limiting or eliminating my driving

- Getting help with my financial decision-making

You may not be close to experiencing one of these transitions, but you still may find thinking about them advantageous. As a matter of fact, we think preparing for these transitions is even more beneficial when you are not on the cusp of such a transition. Why? Making a plan when the need is not immediate, and then regularly reviewing the plan, builds connections in our brain that help those intended plans become default actions when the need eventually arises. The result is a better, smoother, more comfortable transition that allows you the best opportunity to stay in control of your future.

Each of these common aging transitions can have significant personal and financial implications.

None of us has a crystal ball. Illness, injury or disability can occur at any time during our retirement years. Healthcare, legal and financial experts agree that planning for the long-term care needs of yourself, or an older loved one, is extremely important. Although it might not be the most enjoyable topic to ponder, a well-conceived, proactive plan for long-term care can keep you in control of critical decisions and avoid a crisis later in life – one that could be costly and also be in conflict with your or your loved one’s personal preferences and best interests.

The BIG issue is paying for long-term care.

Currently, you may not consider your finances at the appropriate level to qualify for Medicaid (MassHealth). However, down the road, should you find your health declining and yourself potentially needing care in a Skilled Nursing Facility, your savings could take a swift hit. In Massachusetts, care in a Skilled Nursing Facility is averaging between $12,000 – $14,000 per month. With proactive planning, you will be in a better position to protect your savings and potentially benefit from government programs.

Here are some ways you can plan proactively for long-term care.

- Consider your future health needs – According to LongTermCare.gov, recent research suggests that most Americans turning age 65 will need long-term care at some point in their lives. Therefore, it is prudent to consider your future care needs and begin to organize a plan now. In doing so, you should consider your medical record to date as well as your family history.

- Evaluate your options for care – Today, many aging adults want to make sure that they never become a burden on their children. While many families are able to care for a loved one with minimal health needs initially, their needs typically become greater, more time-consuming and more expensive over time – often causing significant disruption and hardship for the well-meaning family members.

- Home care and long-term care in a residential setting are common options. At-home nursing care can become very expensive, especially if it is required on a 24/7 basis. Long-term care, provided at a state-licensed care center, offers the added advantages of three nutritious meals a day, transportation, a nurturing environment, rehabilitation services, a daily calendar of social activities, events and programs, and continuous medical oversight and support.

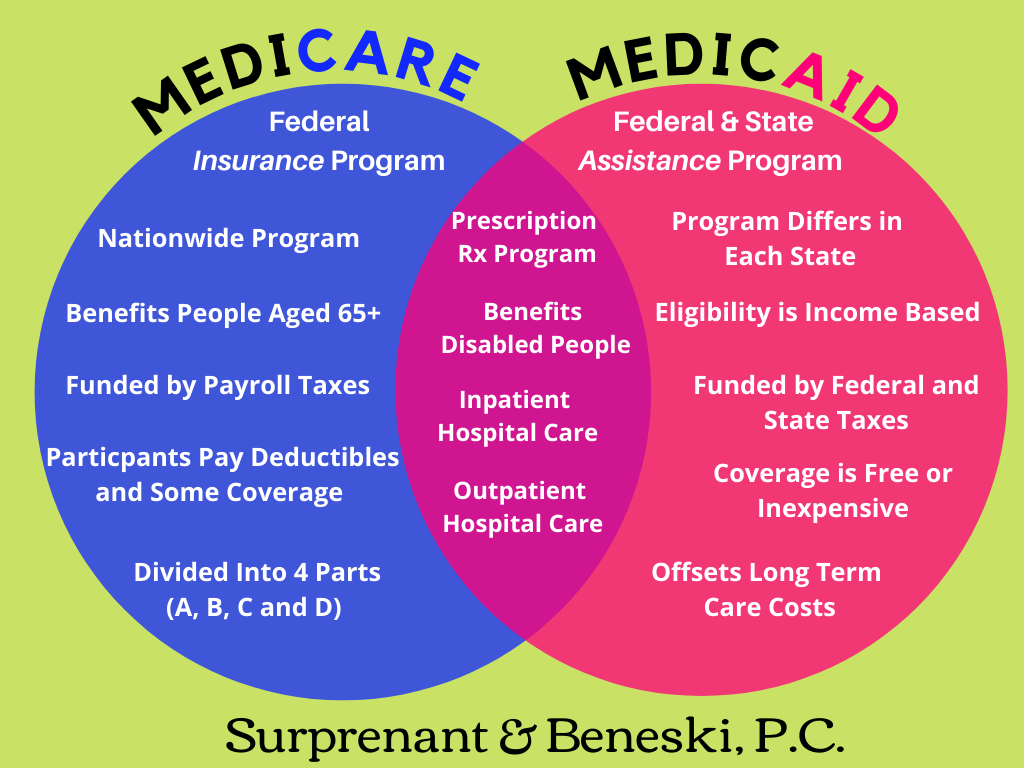

- Assess your payment options – Understanding the costs of long-term care and the best ways to cover them is also a crucial factor. Generally speaking, Medicare does not pay for extended long-term care, and Medicaid only applies for adults who have limited assets or those who’ve nearly depleted their assets. As a result, most people use a variety of other options such as personal income and savings, long-term care insurance, life insurance, annuities and reverse mortgages to pay for their care. Always be sure to contact your Elder Law Attorney for advice and guidance.

- Make appropriate legal decisions – It is recommended that you contact an elder law attorney to help you create the legal documents that will assure you stay in charge of arrangements about your care plan and finances. Elder law attorneys specialize in helping you create valuable documents such as a Power of Attorney or Advanced Directives (also known as Living Wills).

- Consider the potential need for memory care – As Americans live longer, there has been a significant increase in the diagnoses of Alzheimer’s disease and other forms of dementia. Dementia care and support services are highly specialized and should be considered in any long-term care plan today.

©Surprenant & Beneski, P.C. 35 Arnold Street, New Bedford, MA 02740, 336 South Street, Hyannis MA 02601 and 45 Bristol Drive, Easton MA 02375. This article is for illustration purposes only. This handout does not constitute legal advice. There is no attorney/client relationship created with Surprenant & Beneski, P.C. by this article. DO NOT make decisions based upon information in this handout. Every family is unique and legal advice can only be given after an individual consultation with an elder law attorney. Any decisions made without proper legal advice may cause significant legal and financial problems.