Let’s be honest—most of us don’t think about estate planning until we absolutely have to. Maybe you drafted a will or trust years ago and thought, “Great, that’s done. I’m all set.” But here’s the thing: estate planning isn’t a “set it and forget it” kind of deal. Life changes, laws change, and if your documents are stuck in the past, they might not do what you think they...

Estate Planning Blog – Surprenant, Beneski & Nunes

Strengthening Connections with Elderly Loved Ones Through the Power of Nostalgia: How Shared Memories Can Support Meaningful Conversations About Estate Planning

By Attorney Erin L. Nunes, Esq., Managing Partner

As our parents, grandparents, and other aging loved ones grow older, finding meaningful ways to stay connected becomes increasingly important. Many families, however, struggle to start deeper conversations—especially when the topics involve long-term care, wills, or estate planning. One surprisingly effective...

Start the New Year Right: Your 2026 Estate Planning Checkup

Erin L. Nunes, Esq. Managing Partner

The start of a new year naturally encourages us to reflect, set new goals, and get our affairs in order. While you might be focusing on fitness or financial budgets, January is also the perfect time for a crucial task: giving your Estate...

’Tis the Season… to Review Your Estate Plan

By Attorney Erin L. Nunes, Esq., Managing Partner

A Lighthearted Holiday Reminder from Our Team

The holiday season is here—a time filled with family gatherings, festive traditions, and at least one spirited debate about whether “Die Hard” is truly a Christmas movie. Amid the celebrations, it’s also a surprisingly...

“’Tis the Season to… Update Your Will?” A (Gently) Hilarious Holiday Estate Planning Blog

Ah, the holiday season. A magical time of year filled with twinkling lights, festive cookies, and at least one family member who believes “Die Hard” is absolutely a Christmas movie (even though we all know it isn't).

It’s also the one time of year when many of us pause to...

Too Busy for Estate Planning? Why Delaying Could Cost You—and Your Loved Ones—More Than You Think

In a world that celebrates productivity and constant motion, estate planning often slips to the bottom of the to-do list. Between managing careers, raising families, caring for aging parents, and keeping up with daily responsibilities, many people feel they simply don’t have the time to think about wills, trusts, or long-term financial protections.

What to Look for While Visiting Aging Family During the Holidays: A Guide to Future Planning

Spending quality time with family is undoubtedly one of the best things about the holiday season. For those with aging loved ones, this time is especially precious. Beyond making cherished memories, the holidays offer a critical opportunity to observe, assess, and ensure your loved ones are safe, happy, and prepared for the future.

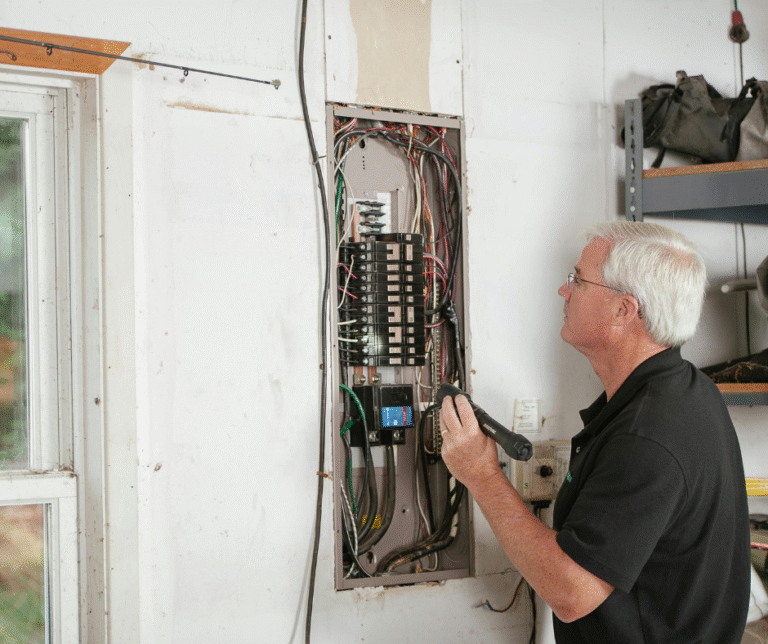

Passing Down Property Just Got Easier: Understanding MA’s Home Inspection Exemptions for Estate Planning

Message from Managing Partner Erin L. Nunes, Esq.

A recent change in Massachusetts law has introduced new home inspection requirements that could impact estate planning strategies involving real estate transfers. Designed to increase transparency and safety in property transactions, the law mandates specific inspection protocols that now apply not...

Understanding and Paying for Nursing Home Costs in Massachusetts

Erin L. Nunes, Esq., Managing Partner

The prospect of nursing home care can be financially daunting. With costs in Massachusetts often exceeding $15,000 per month, understanding the various payment methods and strategies is crucial for individuals and families facing this reality. This article outlines the primary avenues for covering...