An Investment Research Group publication

Introduction

What does E.S.G. stand for? Is it environmental, social, and governance, or is it environmental, sustainable, and governance? Is there a difference between ESG and SRI? If so, what is it? What about impact investing? Is it different from ESG integration? If so, how is it different? All valid questions, and ones you have probably asked yourself if you have researched this once niche corner of investing that is seemingly becoming more mainstream.

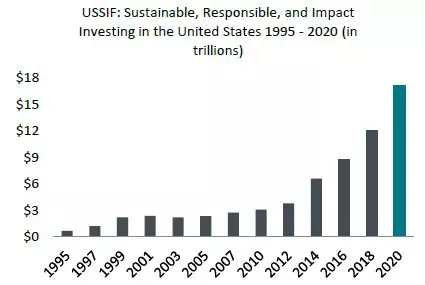

Before we formally define the acronym ESG, let’s dispel the myth that this type of investing is still a niche. According to The Forum for Sustainable and Responsible Investment (USSIF), an authority on sustainable, responsible, and impact investing, investors now consider environmental, social, and governance (ESG) factors across $17.1 trillion of professionally managed assets. This is a 42% increase since 2018.1 This growth in assets has caught the industry’s attention, bringing more participants, both asset managers and investors, to this conversation, and spawned a confusing lexicon, which makes it challenging for investors to differentiate between the various investment approaches and select a strategy.

Values-Based Investing

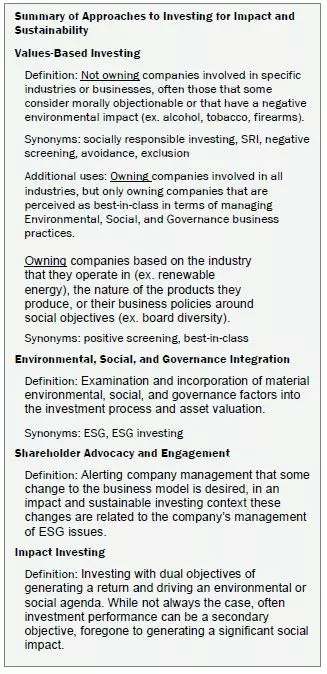

Values-based investing focuses on aligning investments with non-financial values-based objectives. Oftentimes values-based investing is achieved through a negative screening or positive screening approach – which are described below.

Negative screening: Also referred to as socially responsible investing (SRI), avoidance, or exclusion, a values-based investing approach avoids investments in companies or industries based on a certain set of criteria. Traditionally, SRI strategies commonly excluded investments in companies that derive benefit from the sale of tobacco, alcohol, and firearms. As interest in values-based screening has grown, so has the list of exclusions. Commonly excluded investments include those related to fossil fuels, nuclear power, adult entertainment, gambling, genetically modified organisms, and countries involved in human rights violations. Such values-based investing raises questions around the amount of exclusion, its impact on investment performance, and the easiest ways to implement such a strategy.

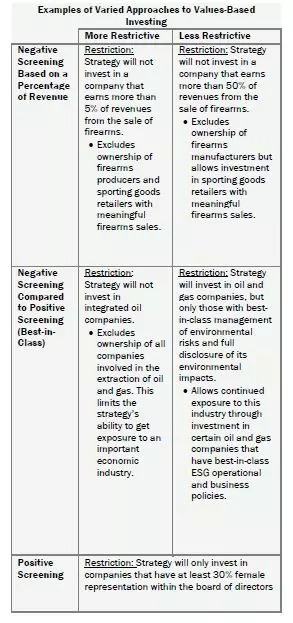

Variations of the exclusion approach exist. Some strategies completely exclude owning stocks which operate in specific industries. For example, an investment strategy may exclude ownership in firearms retailers, excluding a sporting goods retailer with meaningful firearms sales. Other strategies set limits on how much a company can benefit from the eschewed industries. For example, an investment strategy may exclude ownership in companies that generate a specific percentage of the company’s total of revenue from firearms sales. This strategy may be able to own the sporting goods retailer but may exclude ownership of a firearms manufacturer.

Positive screening: Funds using a positive screening approach invest in companies that meet a certain set of criteria. This can be the industry that they operate in, the nature of the products they produce, or their business policies around social objectives. For example, funds that only purchase stocks of companies that meet certain social criteria like a certain number of women in leadership or amount of board diversity. Many thematic funds leverage a positive screening approach.

Another positive screening-based approach is to allow ownership in any company as long as it has “best-in-class” ESG business policies and operations relative to competitors within its industry. This is an extension of

positive screening that enables a strategy to invest in a company in virtually any industry as long as it meets a specified threshold the manager deems “best-in-class”. For example, strategies using this approach may get exposure to

the oil and gas industry by owning a company that has environmentally conscious extraction practices relative to other companies in the industry.

Understanding the difference between negative and positive screening and how each investment manager incorporates values-based or thematic objectives is imperative. Equally important is clearly understanding the investor’s goals and aligning them with the best approach to meet their expectations.

Perusing the published literature on the performance results of values-based investing is inconclusive. For each published article concluding that exclusionary screening does not have adverse impacts on performance, there is often another article to the contrary.

Theoretically, it seems reasonable to assume that winnowing the number of investment choices using an exclusionary screen would lead to underperformance over time, simply because the investable opportunity set has been truncated. Because the published literature is mixed on the topic, we will not address the performance question. However, we note that underperformance may not be unwelcome by those who are dedicated to this form of investing; they may view the risk of underperformance as a necessary cost of morally aligning their investments with their beliefs.

Catering to the unique moral preferences of a wide array of investors makes an exclusionary approach difficult to implement effectively in a pooled vehicle, such as a mutual fund or ETF. Instead, a customized approach may be more easily implemented in a separate account, using an investment manager who is amenable to accommodating the individual investor’s appetite for specific avoidance criteria.

Environmental, Social, and Governance (ESG) Integration

Running parallel with values-based screening is the concept of ESG integration, or just ESG for short. ESG, which is often used as a catch-all term to describe any strategy or fund that falls in this universe, actually has a commonly accepted more specific definition. ESG integration refers to the examination and incorporation of material environmental, social, and governance factors into the investment process and asset valuation

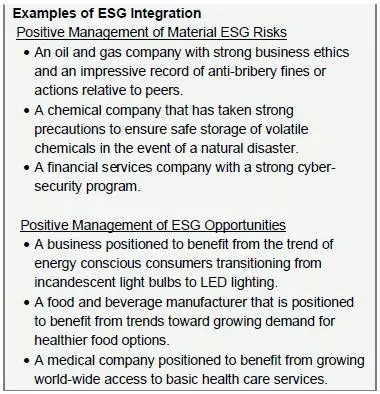

Investors who subscribe to this approach believe markets inefficiently account for ESG risks and opportunities. Because of this perceived inefficiency, proponents see an opportunity to build a portfolio that can generate excess returns through ESG integration, although it has not conclusively proven to do so. For example, an asset manager using an ESG integration approach may apply a higher target price to the stock of a company that has demonstrated a commitment to strict environmental controls and stewardship, by lowering the company’s expense assumptions to account for a lower risk of unexpected regulatory fines and clean-up expenses compared to peers. Another example is a company that produces a water-intensive product, such as semi-conductors, that has demonstrated it has secured access to and conservatively manages water may be considered less risky than a semi-conductor company that is not focused on management of water usage. Some additional examples of material environmental factors include energy efficiency, opportunities in clean transportation, opportunities in renewable energy, and management of carbon emissions.

A company that provides solutions to significant social challenges may look appealing to an analyst using an integrated ESG approach. For example, a technology company with hardware or software solutions that provide developing economies access to personal or commercial banking may be positioned for fast growth as global economic equality continues to become an important social priority. Some additional examples of material social factors include opportunities in healthy lifestyles, access to affordable health care, labor management, cyber-security, access to communication, and product safety & quality.

Some governance factors that are often cited as being material to stock valuations include, reasonable dividend payout ratios, separation of CEO and chairman of the board roles, conservative accounting practices, tax transparency, attendance at board meetings, board member tenure, and regulatory and legal fine history.

The extent to which asset management firms claiming to practice ESG integration have done so varies widely. Firms with more robust ESG integration approaches can provide examples in which material ESG factors influenced buy or sell decisions. Often, these strategies have developed industry and sub-industry specific models that identify and analyze material ESG factors.

Parsing between investment strategies that practice ESG integration and those that use the term as a marketing tactic is integral for investors interested in using these strategies for their potential risk-adjusted return benefits.

Shareholder Advocacy and Engagement

Another approach to impact and sustainable investing is shareholder advocacy and engagement. Advocacy and engagement is the long-time practiced action of alerting company management that some change to the business model is desired by the advocating investors. Historically, these engagements with management have focused on topics outside of ESG, such as those practiced by activist investors, hedge funds, and private equity firms, to unlock financial value. More recently, impact and sustainable investors have adopted this approach and put ESG topics on the agenda.

Investment firms with strong impact and sustainable strategies have put a new twist on advocacy and engagement by focusing on influencing less financially tangible and sometimes non-financial, environmental, social, and governance business practices of the company. Advocacy and engagement methods include voting proxies, filing shareholder resolutions, and dialoguing with company managements committed to improving ESG policies and practices.

Strategies with strong advocacy and engagement efforts may hold stock in companies that seem ill-fit in an impact and sustainability strategy. This may lead investors to question specific holdings if they don’t recognize that the investment manager may be working with the company to improve many of those ESG-related business practices that make the company undesirable.

Those who are most interested in maximizing the non-financial impact of their investments may be interested in strategies with a strong advocacy and engagement approach. Many investment firms committed to advocacy and engagement will highlight the results of their efforts through regularly published reports.

Impact Investing

A combination of value-based investing’s focus on non-financial objectives and advocacy and engagement strategies’ focus on driving an agenda of environmental or social change through equity or debt investment, impact investing also focuses on driving change. However, it is defined separately because impact strategies typically address a specific issue and specific outcome. This contrasts with values-based investing which just addresses a specific set of social or moral objectives. In addition, impact investments don’t require owners to actively participate with management, which is a hallmark of advocacy and engagement strategies.

In fixed income, “green bonds” could be considered impact investments. Green bonds broadly are understood as debt securities tied to environmentally friendly projects. These could be bonds supporting causes such as environmentally friendly public transport, water management, or waste management projects. Traditionally these bonds were issued by multilateral development banks (MDBs) such as the World Bank, or the European Investment Bank. Today, the source of issuance has expanded beyond MDBs to include, public corporations, states and municipalities, and universities and non-profits.2 For example, Toyota has issued green bonds to fund consumer loans and leases for electric, hybrid, and low-emission vehicles.3

Equity impact investments are ownership stakes in companies promoting societal or environmental progress. Many thematic funds focusing on alternative sources of energy, or societal progress such as gender diversity could be considered impact investments. Investors are motivated to marry a strong investment thesis with an overarching agenda of promoting a change about which they are passionate.

Implementing at Ameriprise

The approaches to implementing impact and sustainable investing discussed in this paper are not mutually exclusive. That is, an impact and sustainable investment strategy may combine two or more of these tactics and to varying degrees.

What follows is an overview of the investment strategies covering the major equity and fixed income asset classes that demonstrate strong ESG integration capabilities. These strategies are available as either Active Portfolios investments, mutual funds, ETFs, or separate account strategies (SMAs). Note the strategies listed below are subject to ongoing due diligence from the IRG. Please reference the current research report to determine a product’s rating.

In our opinion, the extent to which an investment incorporates these approaches is only a component of the strategy’s total merit. Said another way, our mission has been to identify strategies that we believe possess strong traditional investment merits while demonstrating strong ESG integration capabilities and a commitment to impact and sustainable investing. While the universe of investments is limited in number, the IRG has not relaxed the standards for obtaining a Recommended rating to accommodate the smaller search universe. For example, a domestic equity product that would traditionally warrant a Neutral rating would not be rated Recommended because it is the best available ESG option. Following is an overview of each of the investment strategies.

Russell Investments, which manages the Ameriprise Active Sustainable Investing World Portfolios., believes that a sound awareness of material ESG factors and a robust investment process can coexist to create value. When researching mutual funds and ETFs to use in this solution, Russell Investments explicitly assesses how well the fund incorporates sustainable investing factors that may affect the manager’s ability to generate excess returns. Russell Investments has found that many funds are managed by teams that have a sound awareness of material ESG factors despite the fund’s name not indicating as such. Based on fund name alone, such funds used in these solutions might appear ill fit in a sustainable investing portfolio. Also, due to a limited availability of high conviction funds that practice ESG integration in some asset classes, there might be instances in which Russell Investments chooses a fund that does not practice ESG integration. The funds used within the Active Sustainable Investing World Portfolios may use negative or positive screening techniques or participate in advocacy and engagement. This series of asset allocation solutions is available across five risk tolerances from conservative to aggressive.

The Starting Point Recommended List has multiple options from iShares for investors looking for ESG strategies through ETFs. While in total there are eight ETFs on the Starting Point Recommend List, they can be distinguished into two categories to better understand the differences between the funds. The first category, which only includes one of the eight ETFs, is made up of strategies that seek to maximize the fund’s exposure to highly rated ESG companies, in this category falls the iShares MSCI USA ESG Select Index ETF. This category of funds can be viewed more similarly to an active mutual fund because the fund’s construction allows its performance and risk profile to be more different from a non-ESG broad benchmark’s performance such as the S&P 500 Index. The second category includes the seven ETFs which the IRG refers to as the iShares Sustainable Core ETFs. The funds in this category are made up of companies that carry high ESG ratings from MSCI, but the funds’ goal is to have returns and risk more like a broad index that represents each funds’ asset class. Investors that are interested in companies that carry higher ESG ratings than their peers but seek performance that is more closely aligned with the broad index’s. Let’s use an example to illustrate the difference between ETFs in each category, the Large Blend ETF in the first category has meaningfully a higher portfolio level ESG score than the Large Blend fund in the second category – note both ESG ETFs have materially higher MSCI ESG rating than the S&P 500 Index. However, in exchange for the higher relative ESG score of the ETF in the first category the investor accepts that the ETF’s performance could deviate more from the S&P 500 Index’s performance than the performance of the Large Blend ETF in category two. The seven funds in the iShares Sustainable Core ETF suite are available across various asset classes including key domestic and international equities and fixed income and could be interesting for investors building an asset allocation model. Additionally, the international and emerging markets ESG ETFs may be interesting, as these are asset classes not represented by active mutual funds on Starting Point.

Eaton Vance’s 2016 acquisition of Calvert Investments combined a leader in equity and fixed income investing with a leader in responsible investing creating compelling offerings across multiple asset classes. The Starting Point Recommended List includes three Calvert mutual funds including Calvert Equity, Calvert Small-Cap, and Calvert Bond, and the Select Separate Account Platform includes the Atlanta High Quality Calvert Equity Strategy. Calvert’s ESG Research Team, which is solely focused on ESG integration and advocacy and engagement, is one of the most well-resourced sustainability teams. Additionally, the funds invest according to the Calvert Principles for Responsible Investment which seek to identify companies that are managing material ESG factors in a manner that will improve shareholder value and societal outcomes. Setting these funds apart from many competitors is Calvert’s commitment to advocacy and engagement. Examples of the firm’s advocacy and engagement accomplishments are detailed in the report titled, Tools of Change, which can be found at www.calvert.com.

In September 2015, the 193 Member States of the United Nations adopted the 17 United Nations Sustainable Development Goals (UNSDGs), designed to end global poverty by 2030 and pursue a sustainable future.4 The AB Sustainable Global Thematic Fund invests solely in companies positioned to benefit as the world moves to this sustainable future. To be owned in the mutual fund, stocks must fit into one (or more) of the 17 UNSDGs, each of which has been assigned to one of three broader sustainable investment themes, climate, empowerment, and health. The fund uses a traditional ESG integration approach to incorporate material ESG risks into each stock’s valuation. Companies that are misaligned with the UNSDGs are excluded from this fund’s investment universe. This includes companies that generate significant revenues from weapons, coal, alcohol, tobacco, pornography, or gambling. AB also participates in shareholder advocacy and engagement to assess how issuers are managing material ESG risks and opportunities and affect positive change with issuers.

Through its strong advocacy and engagement program, Miller/Howard Investments demonstrates its commitment to investing for impact and sustainability. It is important to know, rather than avoiding owning what many consider traditional “sin stocks” such as energy companies, traditional utilities (water, gas, and electric), oil producing companies, Miller/Howard believes ownership coupled with engagement and advocacy is a more effective way to improve stock price performance and affect social and environmental change. For each shareholder resolution Miller/Howard files or co-files, it publishes a write-up detailing the initiative and outcome. A catalog of these write-ups can be found at www.mhinvest.com. Additionally, the firm applies a rigorous and consistent ESG analysis led by a team of four individuals solely focused on ESG analysis and advocacy. The firm also uses negative screening. The Miller/Howard Income Equity Strategy and Miller/Howard Infrastructure Strategy exclude ownership in companies that generate greater than 10% revenues from the production of alcohol, tobacco, or firearms, companies that extract coal, companies provide parts or services that are tailor-made and necessary for the effective function of controversial weapons and companies with serious and persistent human rights violations or environmental abuses. Due to the restricted nature of investing in Infrastructure assets while considering ESG risks, the Miller/Howard Infrastructure Strategy will own nuclear power generating facilities provided that the majority of their power generation does not come from coal as the firm believes the benefits derived from carbon-free energy production outweigh the unique risks attributed to nuclear energy.

One of the best examples we have seen of a strategy that fully implements impact and sustainable investing, while offering a compelling investment thesis is the ClearBridge Appreciation–ESG strategy. This domestic large-cap core strategy, managed by co-portfolio managers Scott Glasser, Michael Kagan, and Mary Jane McQuillen, has provided attractive risk-adjusted returns and seeks strong downside protection properties. This strategy incorporates ESG integration as McQuillen, ClearBridge’s Head of ESG Investing, and dedicated ESG analyst partner with ClearBridge’s general analyst team to integrate material ESG considerations into stock valuations. This strategy excludes for consideration investments in companies ClearBridge has rated “ESG Uninvestable” based on the company’s history of handling ESG business factors. This strategy enerally does not invest in companies that derive significant revenues from certain activities including, extraction of carbon intensive fuels and mining and the manufacture of certain weapons. ClearBridge also participates in advocacy and engagement and publishes examples of its engagement highlights annually in the firm’s Impact Report which can be found at www.clearbridge.com. This strategy is available on the Select Separate Account Platform.

Highlighted by a strong ESG integration approach, Brown Advisory Large-Cap Sustainable Growth is a domestic large-cap growth strategy that seeks to own companies boasting what Brown proprietarily calls, an Environmental Business Advantage (EBA™). Brown believes companies that have an EBA will fundamentally benefit from how they manage ESG-related risks and opportunities. Specifically, companies with an EBA will drive revenue growth, cost improvements, or enhance franchise value. This strategy does not explicitly incorporate a values-based screen. Brown Advisory participates in advocacy and engagement through collaborative conversations with company management teams around how the company is managing ESG related risks and will generally support shareholder proposals the investment team believes are likely to improve shareholder value over time. Brown Advisory’s approach to sustainable investing can be found in the firm’s 2020 Impact Report: Large-Cap Sustainable Growth Strategy which can be found at www.brownadvisory.com. This strategy is available on the Select Separate Account program.

Additional Resources

In addition to the strategies covered in this paper, there are additional investment solutions available at Ameriprise. This includes many available-for-sale mutual funds and ETFs on the Ameriprise brokerage and Ameriprise® SPS platforms. Identifying the universe of impact and sustainable investments can be a challenge as there is not a simple, comprehensive way to do so. Below are additional resources the IRG has found helpful when building a universe of available strategies, that may prove beneficial as you assess these investments.

The Mutual Fund Screener tool, which can be found by searching “Fund Screener” on www.ameriprise.com, can be used to identify all available for sale mutual funds that Morningstar has labeled “Sustainable Investments”. By selecting the “Sustainable Investments” filter, a list of funds is populated, which can be further sorted by Morningstar Category to identify availability by asset class. Using the Mutual Fund Screener, a simple search for sustainable A share funds without a purchase restriction produced 72 results across 30 Morningstar Categories.5

Morningstar provides a sustainability rating for many managed products including mutual funds and exchange traded funds. Using ESG research provider Sustainalytics, the Morningstar Sustainability Rating assigns mutual funds a peer group relative sustainability score based on the fund’s underlying holdings.

This score can be used to assess peer relative sustainability of a fund’s holdings. It is important to note that the Morningstar Sustainability rating does not evaluate the investment firm’s forward-looking commitment to impact and sustainable investing, nor its shareholder advocacy and engagement efforts.

In Conclusion

Given the recent asset growth trends, investors are demanding more value from their investments than strong risk-adjusted returns. Investors are seeking, from their advisors, compelling investment solutions that also align with their unique values and address pressing societal issues.

Grasping the difference between the four approaches to impact and sustainable investing described in this paper, values-based investing, ESG integration, shareholder advocacy and engagement, and impact investing, is a valuable, foundational, step in evaluating investment strategies, and understanding and selecting the most appropriate implementation solution.