Margaret and Sam have always taken care of their daughter, Elizabeth. She is 45, has never worked, and has never left home. She is “developmentally disabled” and receives SSI (Supplemental Security Income). They have always worried about who would take care of her after they die. Some years ago, Sam was diagnosed with dementia. His health has deteriorated to the point that Margaret can no longer take care of him. She has placed Sam in a nursing home and is paying $12,000 per month out of savings. Margaret is worried that there will not be any money left for the care of Elizabeth.

Margaret is satisfied with the nursing home Sam is in. The facility has a Medicaid bed available that Sam could have if he were eligible. Medicaid would pay his bill. However, according to the information she got from the social worker, Sam is $48,000 away from Medicaid eligibility. Margaret wishes there was a way to save the $48,000 to care for Elizabeth after she and Sam are gone. There is.

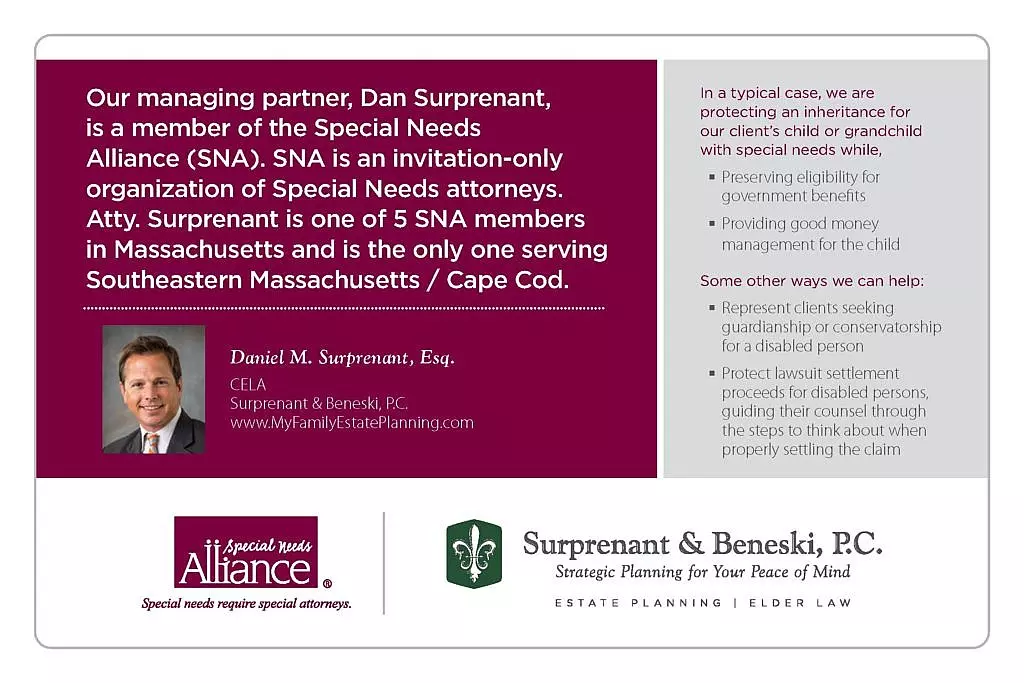

Margaret can consult an Elder Law attorney to set up a particular type of a “special needs trust” with the $48,000 to provide for Elizabeth. As soon as she does, Sam will be eligible for Medicaid. Elizabeth won’t lose her SSI benefits, and her future security is assured.

©Surprenant & Beneski, P.C. 35 Arnold Street, New Bedford, MA 02740, 336 South Street, Hyannis MA 02601 and 45 Bristol Drive, Easton MA 02375. This article is for illustration purposes only. This handout does not constitute legal advice. There is no attorney/client relationship created with Surprenant & Beneski, P.C. by this article. DO NOT make decisions based upon information in this handout. Every family is unique and legal advice can only be given after an individual consultation with an elder law attorney. Any decisions made without proper legal advice may cause significant legal and financial problems.