Are your estate plans in order? Many people put off this vital step, but it's crucial for protecting your loved ones and your assets.

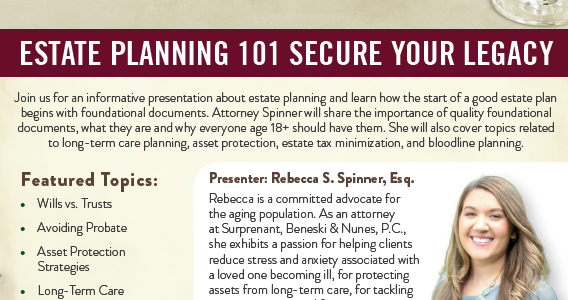

Join Surprenant, Beneski & Nunes, P.C. for a FREE "Estate Planning 101: Secure Your Legacy" workshop! Attorney Rebecca S. Spinner will explain the basics of estate planning, covering wills vs. trusts,...

Archives: Newsletters

Client Newsletter: Jul. 18, 2025

When Siblings Disagree on Parent Care: Legal Pathways to Resolution

Caring for an aging parent is never easy, and it can be even more challenging when adult children don’t see eye to eye. One sibling may want Mom to stay at home with hired help, while another believes a move to assisted living is best. Emotions often run high, especially when the parent’s health...

Client Newsletter: Jul. 11, 2025

Things to Consider When Making Designations in Your Estate Plan

When you create an estate plan, you’re doing more than just passing on your belongings. You’re also deciding who should manage your affairs, take care of loved ones, and carry out your wishes. These designations deserve careful thought. The right people and the right instructions can help prevent confusion, conflict, and delays down the...

Client Newsletter: Jul. 3, 2025

Happy 4th of July!

Our offices will be closed on Independence Day,

Friday, July 4th.

We will reopen on

Monday, July 7th at 8:30am.

Client Newsletter: Jun. 27, 2025

Tips For Managing Sandwich Generation Stress

Balancing the needs of aging parents while raising children of your own can feel like a juggling act with no breaks. This is the reality for many in the “sandwich generation.” You may find yourself arranging doctor appointments for your parents in the morning and attending your child’s school event later that same day....

Client Newsletter: Jun. 20, 2025

Reasons Why MassHealth Benefits Could Be Revoked

MassHealth plays a vital role in providing health coverage to many Massachusetts residents, especially older adults and those with disabilities. But qualifying once doesn’t mean you’re set for life.

Client Newsletter: Jun. 13, 2025

When to Talk to Your Parents About Long-Term Care

Bringing up long-term care with your parents isn’t easy. It can feel awkward, emotional, and sometimes even unnecessary—especially if your parents are still relatively independent. But waiting until something happens can leave you scrambling.

Client Newsletter: Jun. 6, 2025

Off to College? Don’t Forget About the Essentials!

This exciting time of year brings prom, graduation, and prepping for college. But before your 18-year-old heads off, there’s something crucial to consider: their estate plan.

Client Newsletter: May. 30, 2025

Your 2025 Action Plan for Peace of Mind: A Step-by-Step Guide

As an attorney specializing in estate planning and elder law, I’m here to help you navigate the important steps to protect yourself and your loved ones in 2025. Think of this as your personal roadmap to peace of mind, not a complicated legal lecture!

Client Newsletter: May. 23, 2025